Evidence-Based Retirement Advice

Financial Facts, Not Fiction

The core value of our retirement advice service is to rely upon financial science. This gives you confidence with money, a pre-requisite for a successful retirement.

The core value of our retirement advice service is to rely upon financial science. This gives you confidence with money, a pre-requisite for a successful retirement.

We also appreciate that you need to understand what benefits and value you receive from us.

Below are the 6 Financial Steps that we believe is important for modern retirement advice.

We are confident that your retirement will be better having met us. This is why we have the confidence to offer you a Money Back Guarantee for your Retirement Plan.

If you are not happy with the retirement plan then we will give you a refund – no hassles.

Step 7 – Use Retirement Advice Specialists

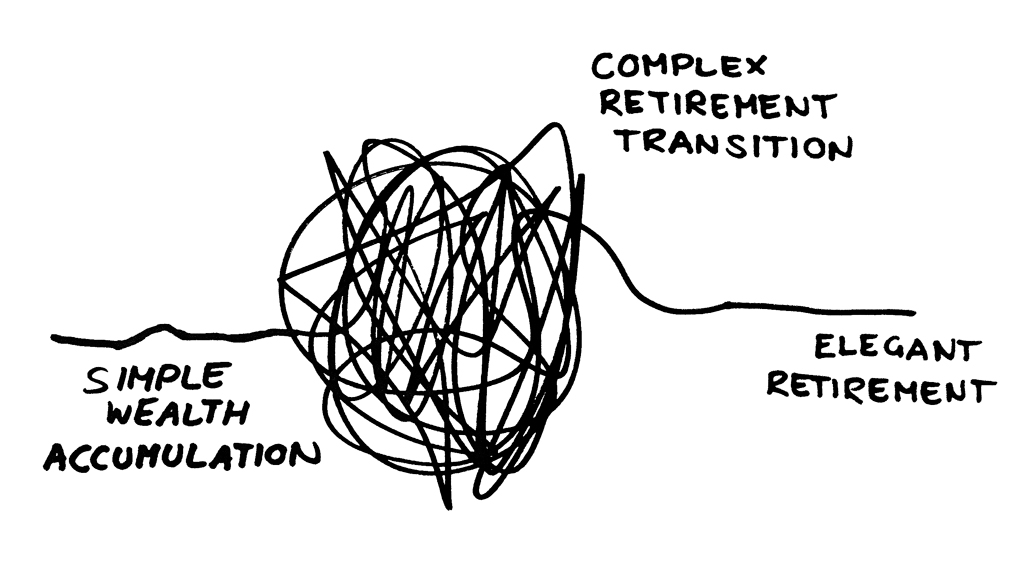

They termed this as ‘advice gamma’.

They termed this as ‘advice gamma’.

This is the value clients may potentially receive by utilising those techniques.

We have implemented our retirement strategies using academic research as our core value of our service.

Fortunately, these strategies do incorporate the 5 factors identified by Morningstar so as to potentially prolong how long your money will last in retirement.

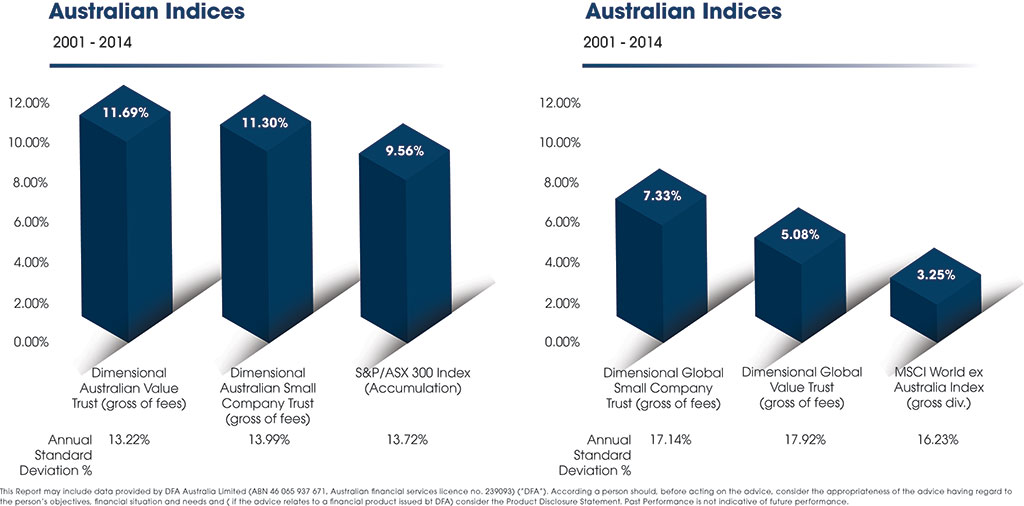

Step 8 – Understand Investment Performance

For more than 12 years we have implemented superannuation and pension portfolio strategies founded upon rigorously proven academic research.

Our view is that as you progress towards and into retirement, you deserve a successful retirement experience, which means investing with no surprises.

Our superannuation and pension portfolios aim to deliver scientifically proven solutions that have historically outperformed the broad market.

These strategies are focused upon the 5 Factor Model of Investing for which includes the work of Professor Eugene Fama, whom recently won a Nobel Prize for his research.

As shown in the graphs below, this form of investment has historically provided higher returns of between 1.74% and 4.08% per year in the Australian and Global Markets respectively from 2001-2014 (Source: DFA Australia, 2014).

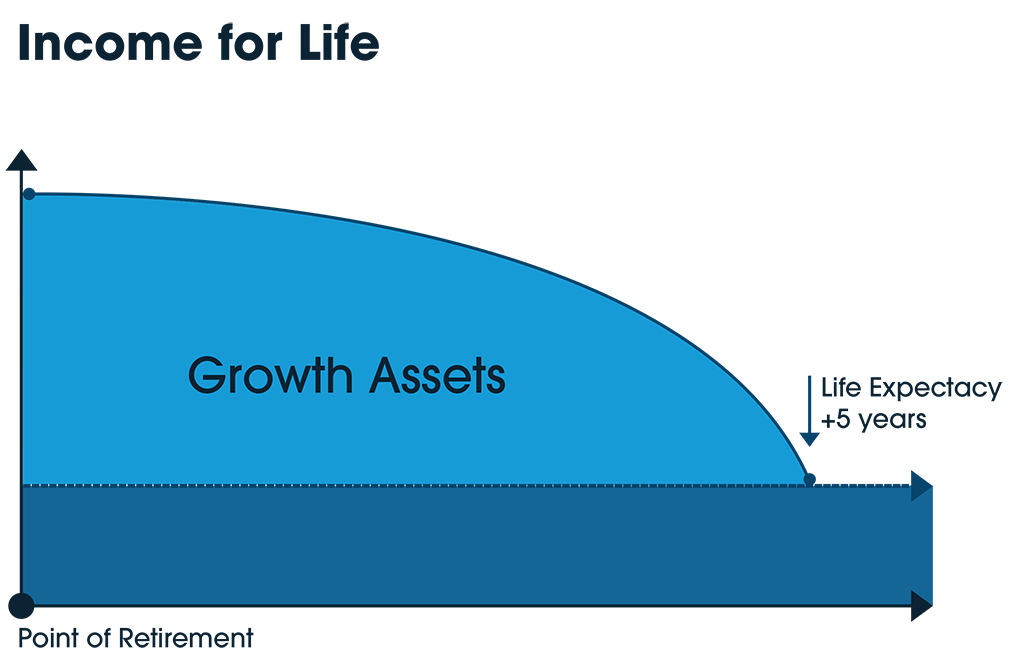

Step 9 – Make Your Money Last

Modern retirement income portfolios are focused upon income.

For a moment, consider a farmer.

Farmers care more about the yield of crops harvested each month. The focus is not the price of the land that the crops grow upon.

It’s the same in retirement.

Smooth, secure monthly income is the objective. Not the fluctuating value of the number on the bottom of the bank statement.

The development of a floor of safe income for a defined level of retirement income, with any remaining assets invested for upside growth, gives you a foundation of preparedness.

Your financial life will be very different in retirement. You need a new plan to manage it.

Step 10 – A Clear Direction

A documented investment philosophy tailored for your retirement is a necessity.

Based upon practical experience, as well as independent research, the number 1 determinant of portfolio success is typically your own emotional responses.

Investor behaviour has been shown to historically underperform the markets of up to 3.96% per year. (Dalbar 2013)

Our aim is to help investors through education. By understanding the fundamentals of investing, you gain clarity and discipline. This leads to a successful experience.

From the start of your investment journey, we construct a tailored investment philosophy so that you have a document for which you can anchor future decisions upon.

This assists to reduce the noise of the media every day, and reduces your emotion towards short term fluctuations in values.

Step 11 – An Experienced Guide

Use an adviser that has been along this journey many times before.

Retirement is one of life’s most stressful events. With decades of experience in the TRAC team, we can help you along every step of the way.

AON Hewitt research identified investors with an adviser have a 1.8 to 2.92% per year outperformance compared to those without an adviser (AON, 2011).

Texas Tech University also published research that states those working with a retirement plan 5-10 years ahead had increased their wealth by $157,427 compared to those without a plan (Texas Tech, 2011).

The role of money in retirement is to be confident that you can enjoy the lifestyle of your choosing for as long as you live.

As shown in the image, our 5 silo retirement structure is a starting point to prepare you financially for virtually anything that may happen.

Step 12 – Long Term Relationship

Age well and be happy.

Australian research company, Core Data (2010) identified that clients of advisers are generally more happier with their finances than those that do not have an adviser.

The ageing process may have something to do with this evidence.

Research from Texas Tech University (2011) demonstrate that as we age, our financial literacy scores decline by about 1% each year past the age of 60. Interestingly, our financial confidence does not diminish and remains quite high regardless of our ability.

As we age, having a trusted adviser to assist and partner with you to guide your decisions on money, can reduce the risk of damaging your own wealth – no matter how unintentional it may be.